Mastering Trading with Assets A Comprehensive Guide

Mastering Trading with Assets

Trading with assets is an essential skill for anyone looking to succeed in the financial markets. Whether you’re interested in stocks, commodities, currencies, or cryptocurrencies, understanding how to trade these assets effectively is critical. In this article, we will delve into the various aspects of trading with assets, offering insights into different strategies and tips to enhance your trading experience. Additionally, we will explore the importance of Trading with Assets negociação com os ativos and how it can facilitate better trading results.

Understanding Financial Markets

The world of finance is vast and complex, comprising various markets where different assets are traded. These markets are classified into numerous categories, including:

- Stock Markets

- Bond Markets

- Commodity Markets

- Forex Markets

- Cryptocurrency Markets

Each of these markets has unique characteristics, making it essential for traders to understand the specifics of the markets they wish to engage in. For instance, stock markets involve buying and selling shares of publicly traded companies, while commodities markets deal with raw materials like gold, oil, and agricultural products.

Types of Assets

Understanding different types of assets is crucial for successful trading. Assets can be broadly categorized into two types: tangible and intangible assets.

Tangible Assets

Tangible assets are physical items that have intrinsic value. Examples include:

- Real estate properties

- Machinery and equipment

- Commodities like precious metals

Intangible Assets

Intangible assets, on the other hand, do not have a physical presence but hold value. Examples include:

- Intellectual property (patents, copyrights)

- Brand reputation

- Financial securities (stocks and bonds)

Trading Strategies

Having a well-defined trading strategy is fundamental to success in the financial markets. Let’s discuss some popular trading strategies:

Day Trading

Day trading involves buying and selling assets within the same trading day. Traders who engage in day trading look to take advantage of small price movements, making multiple trades throughout the day. This strategy requires quick decision-making and is often suitable for individuals who can dedicate considerable time to monitoring market movements.

Swing Trading

Swing trading is a medium-term strategy where traders hold assets for several days to weeks. The goal is to capture larger price movements by taking advantage of market “swings.” This approach allows traders to benefit from trends while not being glued to their screens all day.

Position Trading

Position trading is a long-term strategy that involves holding assets for months or even years. Traders who adopt this strategy typically perform extensive market analysis to identify fundamental shifts in the market that might affect asset prices over the long term.

Market Analysis Techniques

Traders utilize various analysis techniques to make informed decisions. The two primary types of analysis are:

Fundamental Analysis

Fundamental analysis involves evaluating a company’s financial health, market conditions, and economic factors. Traders look at key indicators like earnings reports, company news, and macroeconomic data to determine the intrinsic value of an asset.

Technical Analysis

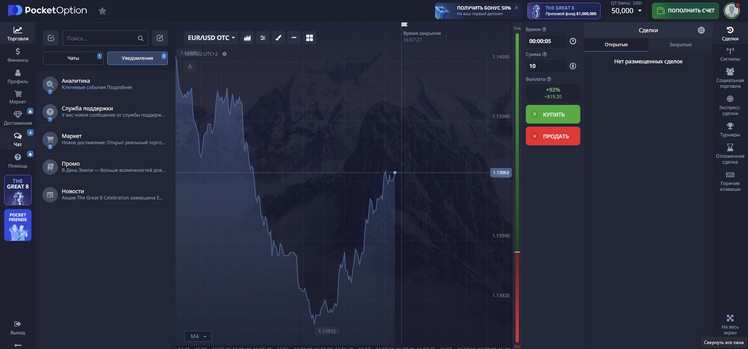

Technical analysis focuses on price movement and patterns on charts. Traders use various tools, including trend lines, support and resistance levels, and indicators (like MACD, RSI) to predict future price movements based on historical data.

Risk Management

Risk management is an integral part of trading, as it determines how much loss a trader can tolerate before exiting a trade. Effective risk management strategies include:

- Setting stop-loss and take-profit levels to limit potential losses and secure profits.

- Utilizing position sizing to manage the amount of capital allocated to a single trade based on the trader’s overall account size and risk tolerance.

- Diversifying an investment portfolio to mitigate risks associated with any single asset.

The Role of Psychology in Trading

Trading is not just about numbers; psychology plays a critical role in decision-making. Traders often experience a range of emotions, including fear, greed, and impatience, which can influence their actions. Developing a trading plan and sticking to it can help mitigate emotional decision-making.

Staying Informed

Markets are constantly changing, and staying informed about economic news, market trends, and geopolitical events is vital for traders. Engaging with financial news platforms and utilizing social media to follow market experts can provide insights that may influence trading decisions.

Conclusion

Trading with assets is a multifaceted endeavor that requires a combination of knowledge, strategy, and psychological resilience. Whether you are a novice trader just starting or an experienced trader looking to refine your skills, understanding the fundamentals of trading, market analysis, risk management, and the psychological aspects can help you navigate the complexities of financial markets. With the right approach and continuous education, you can enhance your trading capabilities and work towards achieving your financial goals.